Understanding the Importance of an Investment Fee Calculator

Investing in financial markets can be a profitable venture, but it is critical to understand the fees involved with your investments. An investing fee calculator is a useful tool in this context. This article will look at the importance of investment fees, how an investment fee calculator may help investors make better decisions, and the different sorts of fees that might affect investment returns.

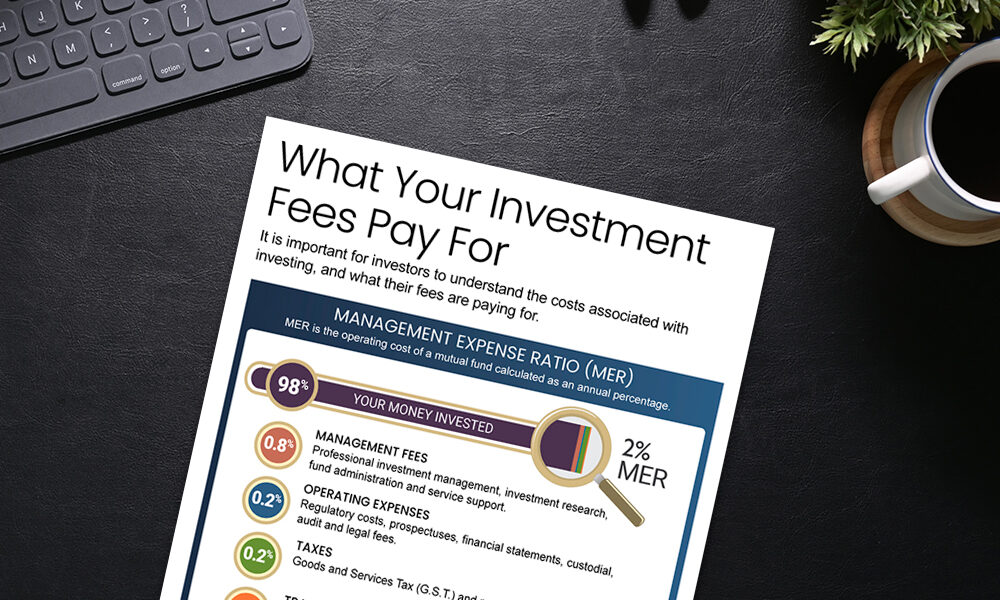

Investment fees have a big impact on overall results, often more than investors realize. Even seemingly insignificant fees can diminish investment returns over time because of the force of compounding. As a result, recognizing and managing these fees is critical for increasing returns and meeting financial objectives.

5 Types of Investment Fees

Investors can confront a variety of costs, including:

- Management Fees: Mutual funds, ETFs, and investment managers charge fees for portfolio management.

- Expense Ratios: Annual fees are expressed as a proportion of your mutual fund or ETF investment.

- Transaction Fees: Fees charged when purchasing or selling shares, such as commissions and brokerage fees.

- Account Maintenance Fees: Brokerage firms impose periodic fees to maintain your account.

- Advisory Fees: Financial advisors are paid to provide investment advice and manage portfolios.

Understanding these costs and how they affect your assets is critical for making sound decisions and maximizing your investing plan.

What is an investment fee calculator?

An investment fee calculator is a digital tool that allows investors to calculate the impact of various fees on their investment returns over time. By entering information such as the initial investment amount, estimated yearly return, investment duration, and charge structure, investors can calculate how much of their earnings will be devoured by fees.

How It Works

Investment fee calculators normally require the following inputs:

- Initial Investment Amount: The sum of money you begin with.

- Annual Contribution: Any additional donations made annually.

- Expected Annual Return: The anticipated annual return on your investment.

- Investment Duration: The number of years you intend to invest.

- Fee Structure: This includes management fees, cost ratios, transaction fees, and any additional fees that may apply.

The calculator uses these parameters to estimate how much you will pay in fees over time and how these costs will affect your final investment value.

4 Advantages of Using an Investment Fee Calculator

Using an investing fee calculator has various advantages:

- Clarity & Transparency: Investment fee calculators offer a clear and transparent perspective of the fees associated with multiple investment options. This transparency enables investors to understand where their money is going and how fees may affect their returns.

- Informed Decision-Making: Investors can make better selections when they understand the implications of fees. For example, they may select lower-cost investment options or negotiate lower costs with their financial advisors.

- Comparative Analysis: Investment fee calculators enable comparative study of various investment possibilities. By comparing the fees and net returns of several funds or investment strategies, investors can select the most cost-effective option that best meets their financial objectives.

- Long-Term Planning: Understanding the long-term impact of fees is critical for retirement planning and other financial objectives. Investment fee calculators assist investors in making long-term financial decisions by displaying how fees will affect their portfolios.

Sum Up

Investment fee calculators are important tools for investors who want to understand and control the fees connected with their investments. These calculators help to make educated decisions and plan for the future by offering clarity and transparency. Understanding the effects of fees can help investors select more cost-effective investing solutions, allowing them to optimize their profits.

In a world where every percentage point matters, understanding and managing investment fees is an essential component of successful investing. Whether you are a rookie investor or a seasoned professional, using an investment fee calculator should be a part of your overall investment strategy.